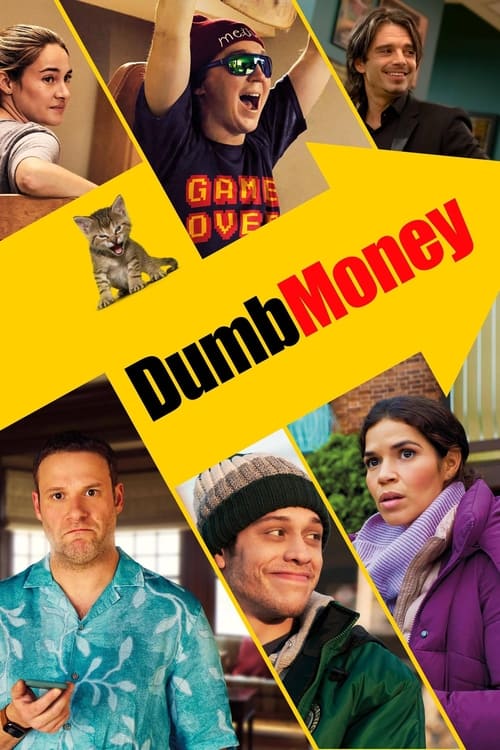

Dumb Money

Vlogger Keith Gill sinks his life savings into GameStop stock and posts about it. When social media starts blowing up, so do his life and the lives of everyone following him. As a stock tip becomes a movement, everyone gets rich—until the billionaires fight back, and both sides find their worlds turned upside down.

The film struggled financially against its moderate budget of $30.0M, earning $20.7M globally (-31% loss). While initial box office returns were modest, the film has gained appreciation for its innovative storytelling within the history genre.

1 win & 2 nominations

Plot Structure

Story beats plotted across runtime

Narrative Arc

Emotional journey through the story's key moments

Story Circle

Blueprint 15-beat structure

Arcplot Score Breakdown

Weighted: Precision (70%) + Arc (15%) + Theme (15%)

Dumb Money (2023) exemplifies carefully calibrated narrative design, characteristic of Craig Gillespie's storytelling approach. This structural analysis examines how the film's 15-point plot structure maps to proven narrative frameworks across 1 hour and 45 minutes. With an Arcplot score of 7.4, the film balances conventional beats with creative variation.

Characters

Cast & narrative archetypes

Keith Gill

Jennifer Campbell

Harmony Williams

Marcus Barcia

Riri

Gabe Plotkin

Steve Cohen

Ken Griffin

Vlad Tenev

Main Cast & Characters

Keith Gill

Played by Paul Dano

Financial analyst and Reddit user who sparks the GameStop short squeeze, streaming his investment strategy as Roaring Kitty.

Jennifer Campbell

Played by Shailene Woodley

Keith's supportive wife and nurse who stands by him through the financial roller coaster.

Harmony Williams

Played by America Ferrera

Single mother and GameStop employee who invests her savings after following Keith's advice.

Marcus Barcia

Played by Anthony Ramos

College student and amateur investor who joins the GameStop movement from his dorm room.

Riri

Played by Myha'la Herrold

Nurse and Keith's brother, struggling financially but joining the investment movement.

Gabe Plotkin

Played by Seth Rogen

Hedge fund manager at Melvin Capital who takes massive short positions against GameStop.

Steve Cohen

Played by Vincent D'Onofrio

Billionaire hedge fund manager and owner of Point72 who becomes involved in the crisis.

Ken Griffin

Played by Nick Offerman

CEO of Citadel Securities who plays a key role in the trading halt controversy.

Vlad Tenev

Played by Sebastian Stan

CEO of Robinhood who faces backlash after restricting GameStop trading.

Structural Analysis

The Status Quo at 1 minutes (1% through the runtime) establishes Keith Gill (Roaring Kitty) sits in his basement streaming to a small audience, working his day job at MassMutual while studying GameStop stock. His ordinary life: financial analyst by day, YouTube streamer by night, living with family, dismissed by mainstream finance.. Of particular interest, this early placement immediately immerses viewers in the story world.

The inciting incident occurs at 12 minutes when Keith posts his "Deep F*ing Value" GameStop analysis on r/WallStreetBets showing his significant investment position. The post gains traction and others begin to notice the massive short interest. The data shows GameStop is over 100% shorted - an opportunity emerges.. At 12% through the film, this Disruption** aligns precisely with traditional story structure. This beat shifts the emotional landscape, launching the protagonist into the central conflict.

The First Threshold at 26 minutes marks the transition into Act II, occurring at 24% of the runtime. This shows the protagonist's commitment to Keith doubles down on his GameStop position, actively choosing to risk everything despite criticism. The r/WallStreetBets community members make their choice to buy and hold GME stock. Ordinary investors commit their savings to the cause - crossing into active rebellion against Wall Street., moving from reaction to action.

At 51 minutes, the Midpoint arrives at 49% of the runtime—precisely centered, creating perfect narrative symmetry. The analysis reveals that this crucial beat False victory: GameStop stock explodes upward, reaching unprecedented heights. Keith's position is worth tens of millions. Retail investors are euphoric. News coverage goes mainstream. It appears they've won against Wall Street - but this draws dangerous attention from the financial establishment., fundamentally raising what's at risk. The emotional intensity shifts, dividing the narrative into clear before-and-after phases.

The Collapse moment at 77 minutes (73% through) represents the emotional nadir. Here, The stock crashes when Robinhood halts trading. Fortunes evaporate. The dream dies. Some retail investors lose their life savings. The realization hits: the game was always rigged, and when they started winning, the powerful changed the rules. Whiff of death: the death of the belief that the system could be fair., indicates the protagonist at their lowest point. This beat's placement in the final quarter sets up the climactic reversal.

The Second Threshold at 83 minutes initiates the final act resolution at 79% of the runtime. Keith decides to testify before Congress and realizes the true victory isn't just money - it's exposing the corruption. The synthesis: combining his financial knowledge with the community's moral cause. He sees that holding the stock is a statement. "I like the stock." The movement was never just about profit., demonstrating the transformation achieved throughout the journey.

Emotional Journey

Dumb Money's emotional architecture traces a deliberate progression across 15 carefully calibrated beats.

Narrative Framework

This structural analysis employs a 15-point narrative structure framework that maps key story moments. By mapping Dumb Money against these established plot points, we can identify how Craig Gillespie utilizes or subverts traditional narrative conventions. The plot point approach reveals not only adherence to structural principles but also creative choices that distinguish Dumb Money within the history genre.

Craig Gillespie's Structural Approach

Among the 8 Craig Gillespie films analyzed on Arcplot, the average structural score is 7.2, reflecting strong command of classical structure. Dumb Money represents one of the director's most structurally precise works. For comparative analysis, explore the complete Craig Gillespie filmography.

Comparative Analysis

Additional history films include The Attacks Of 26/11, Joyeux Noel and Rob Roy. For more Craig Gillespie analyses, see Fright Night, I, Tonya and Cruella.

Plot Points by Act

Act I

SetupStatus Quo

Keith Gill (Roaring Kitty) sits in his basement streaming to a small audience, working his day job at MassMutual while studying GameStop stock. His ordinary life: financial analyst by day, YouTube streamer by night, living with family, dismissed by mainstream finance.

Theme

Keith's brother or a Redditor states the core theme: "The system is rigged against the little guy" or discusses how Wall Street elites profit while regular people lose everything. The film's central question: Can ordinary people beat Wall Street at their own game?

Worldbuilding

Introduction to the ensemble: Keith streaming his GameStop thesis, college student Riri struggling financially, nurse Jenny working shifts, GameStop retail workers Marcus and Harmony barely making ends meet. Establishing the wealth gap: Gabe Plotkin at Melvin Capital shorting GameStop, Steve Cohen's luxury, Ken Griffin's empire. The r/WallStreetBets community culture.

Disruption

Keith posts his "Deep F***ing Value" GameStop analysis on r/WallStreetBets showing his significant investment position. The post gains traction and others begin to notice the massive short interest. The data shows GameStop is over 100% shorted - an opportunity emerges.

Resistance

Keith debates whether to go all-in while his wife Caroline expresses concern about their finances. The Reddit community debates the risk and potential. The everyday investors wrestle with whether to invest their limited savings. Skepticism from family, friends, and colleagues. Keith continues researching and posting updates.

Act II

ConfrontationFirst Threshold

Keith doubles down on his GameStop position, actively choosing to risk everything despite criticism. The r/WallStreetBets community members make their choice to buy and hold GME stock. Ordinary investors commit their savings to the cause - crossing into active rebellion against Wall Street.

Mirror World

The r/WallStreetBets community becomes Keith's mirror world - representing collective action and solidarity. Relationships deepen among the retail investors as they share their stories and motivations. This subplot carries the theme: together, the powerless can become powerful.

Premise

The promise of the premise: watching GameStop stock rise as retail investors pile in. The thrill of gains, the "stonks only go up" memes, the growing online community. Hedge funds begin to feel pressure. News coverage starts. The little guys are winning. Social media explodes with diamond hands and rocket emojis.

Midpoint

False victory: GameStop stock explodes upward, reaching unprecedented heights. Keith's position is worth tens of millions. Retail investors are euphoric. News coverage goes mainstream. It appears they've won against Wall Street - but this draws dangerous attention from the financial establishment.

Opposition

The system fights back. Robinhood and other brokers restrict buying GME stock - only selling allowed. Melvin Capital gets bailout from Citadel and Point72. Mainstream media attacks retail investors as reckless. Congressional hearings loom. Legal pressure mounts. The establishment closes ranks to protect itself.

Collapse

The stock crashes when Robinhood halts trading. Fortunes evaporate. The dream dies. Some retail investors lose their life savings. The realization hits: the game was always rigged, and when they started winning, the powerful changed the rules. Whiff of death: the death of the belief that the system could be fair.

Crisis

Keith and the retail investors process the betrayal. Depression, anger, disillusionment. Media vilifies them. Relationships strain under financial and emotional pressure. The dark night of reckoning with what they've lost and whether it meant anything. The community questions whether to hold or give up.

Act III

ResolutionSecond Threshold

Keith decides to testify before Congress and realizes the true victory isn't just money - it's exposing the corruption. The synthesis: combining his financial knowledge with the community's moral cause. He sees that holding the stock is a statement. "I like the stock." The movement was never just about profit.

Synthesis

Congressional testimony where Keith calmly defends retail investors and exposes market manipulation. The community holds strong despite losses. Media narrative begins to shift. The system is forced to acknowledge the rigging. While hedge funds survived, the world now knows the truth. Cultural victory over financial defeat.

Transformation

Final image mirrors the opening but transformed: Keith still in his basement, but now recognized worldwide. The retail investors didn't get rich, but they exposed Wall Street corruption and found community. The system is still rigged - but now everyone knows it. From invisible to historic.